Related Jobs

View all jobsSenior Credit Risk Data Analyst

Senior Data Engineer

Senior Data Engineer

Senior Data Analyst - Fraud Analytics

Senior Data Analyst

Subscribe to Future Tech Insights for the latest jobs & insights, direct to your inbox.

Industry Insights

Discover insightful articles, industry insights, expert tips, and curated resources.

Machine Learning Recruitment Trends 2025 (UK): What Job Seekers Need To Know About Today’s Hiring Process

Summary: UK machine learning hiring has shifted from title‑led CV screens to capability‑driven assessments that emphasise shipped ML/LLM features, robust evaluation, observability, safety/governance, cost control and measurable business impact. This guide explains what’s changed, what to expect in interviews & how to prepare—especially for ML engineers, applied scientists, LLM application engineers, ML platform/MLOps engineers and AI product managers. Who this is for: ML engineers, applied ML/LLM engineers, LLM/retrieval engineers, ML platform/MLOps/SRE, data scientists transitioning to production ML, AI product managers & tech‑lead candidates targeting roles in the UK.

Why Machine Learning Careers in the UK Are Becoming More Multidisciplinary

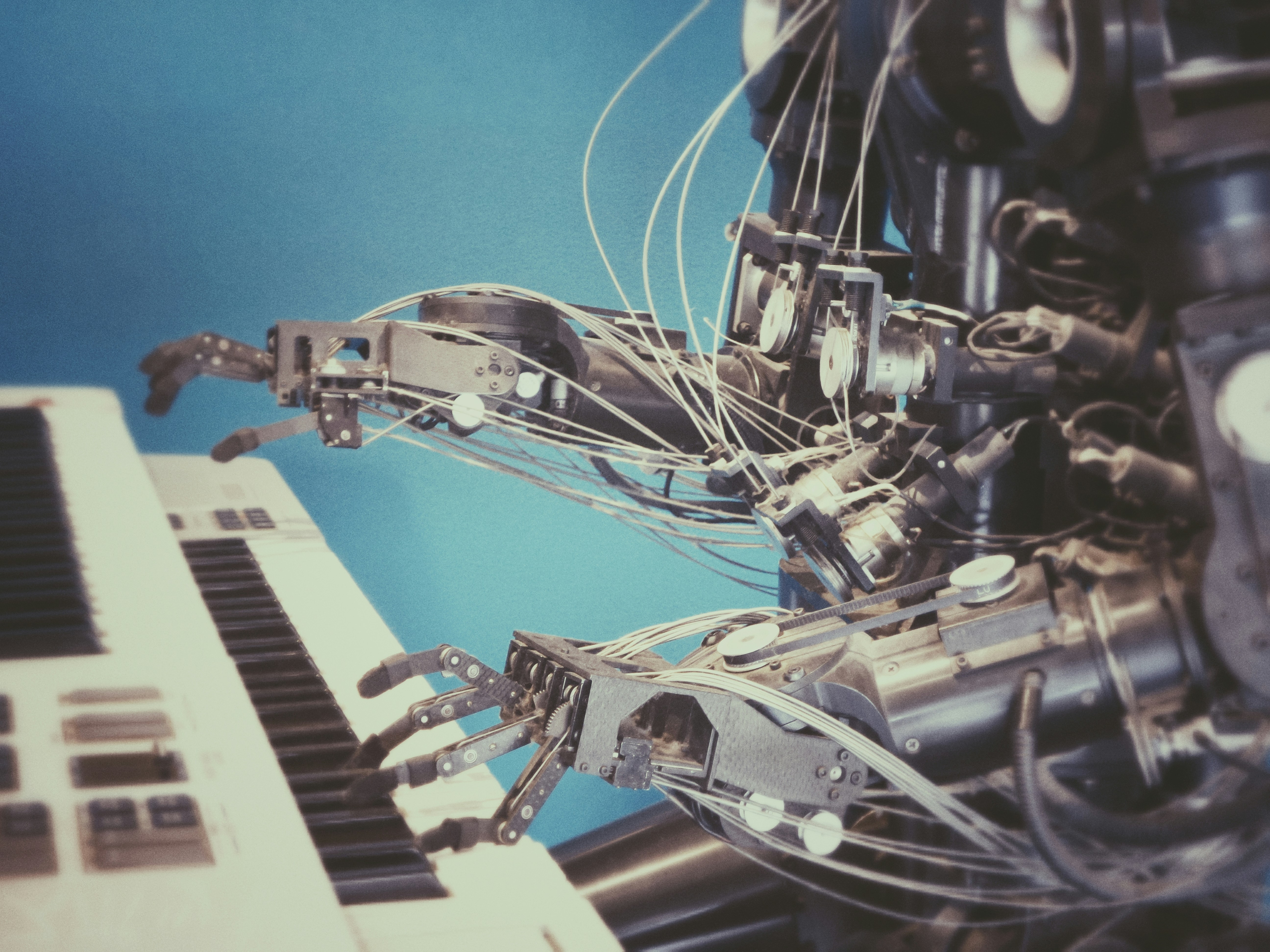

Machine learning (ML) has moved from research labs into mainstream UK businesses. From healthcare diagnostics to fraud detection, autonomous vehicles to recommendation engines, ML underpins critical services and consumer experiences. But the skillset required of today’s machine learning professionals is no longer purely technical. Employers increasingly seek multidisciplinary expertise: not only coding, algorithms & statistics, but also knowledge of law, ethics, psychology, linguistics & design. This article explores why UK machine learning careers are becoming more multidisciplinary, how these fields intersect with ML roles, and what both job-seekers & employers need to understand to succeed in a rapidly changing landscape.

Machine Learning Team Structures Explained: Who Does What in a Modern Machine Learning Department

Machine learning is now central to many advanced data-driven products and services across the UK. Whether you work in finance, healthcare, retail, autonomous vehicles, recommendation systems, robotics, or consumer applications, there’s a need for dedicated machine learning teams that can deliver models into production, maintain them, keep them secure, efficient, fair, and aligned with business objectives. If you’re hiring for or applying to ML roles via MachineLearningJobs.co.uk, this article will help you understand what roles are typically present in a mature machine learning department, how they collaborate through project lifecycles, what skills and qualifications UK employers look for, what the career paths and salaries are, current trends and challenges, and how to build an effective ML team.